While the Corona crisis is currently affecting millions worldwide, I wanted to already share with you a fragment of a book I’m currently writing about innovation in the new economy. The fragment is about how a crisis or disruption can create a (spontaneous) need for innovation and could open up opportunities for innovative companies to address new and changed market needs.

Schumpeterian economics

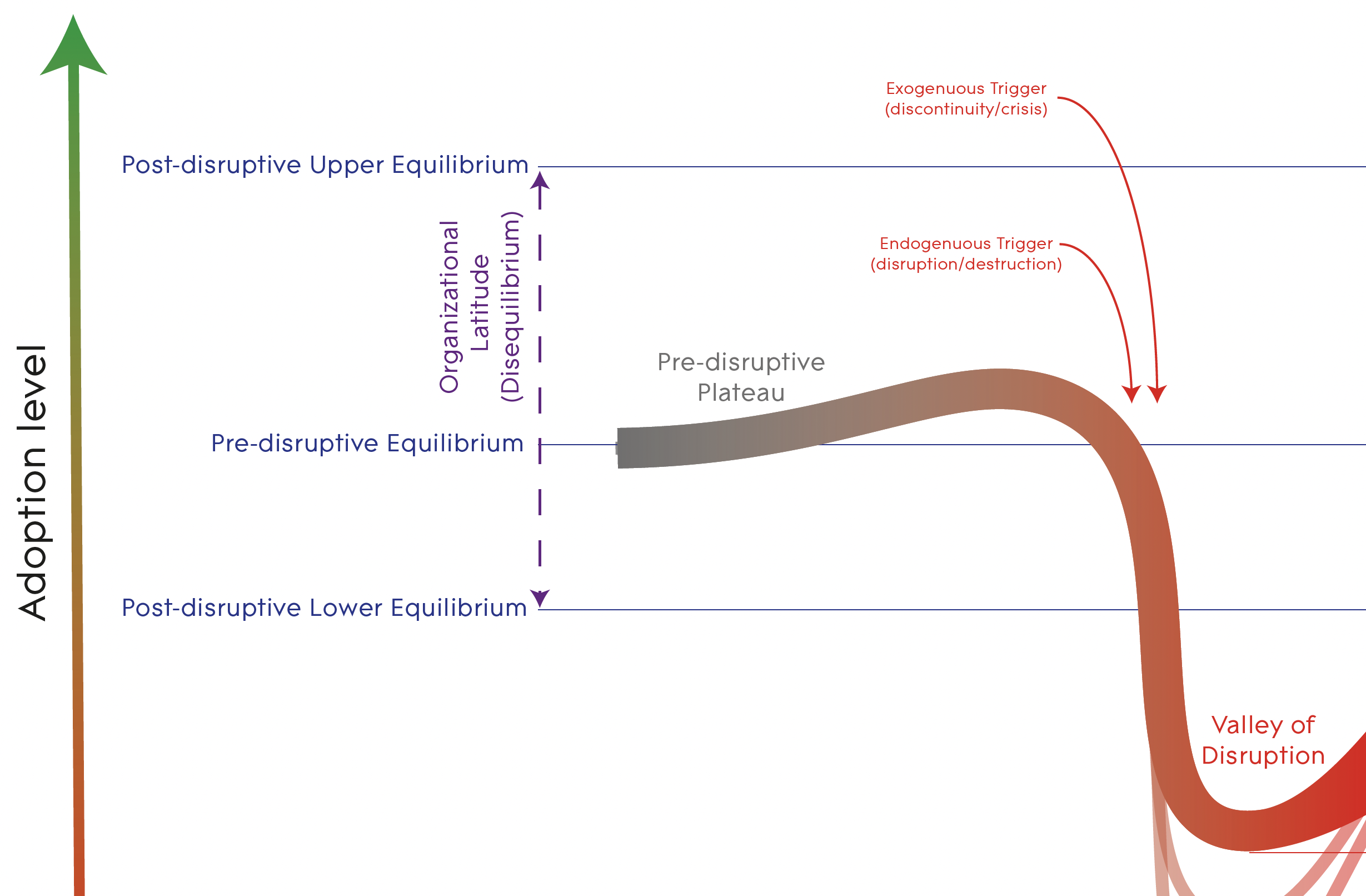

Although it wasn’t highly recognized at the time, the Schumpeterian approach to disequilibrative economics have been widely adopted nowadays. Schumpeter (1942) describes the entrepreneur as disequilibrative – destroying the pre-existing stage of the equilibrium (Kirzner, 1999). This concept is also called ‘creative destruction‘. Through this behaviour, markets will be in continuous cycles of reaching new equilibria and disruptions of that new equilibria. This approach relates to the diffusion of innovation, as was introduced by Rogers (2010). Towards the stage of a market equilibrium, new technology, services and products spread across its intended consumer markets: innovation gets adopted firstly by innovators and early adaptors – who trigger the market disruptions – then (if successful) followed by the early and late majority, reassuring a new equilibrium in the market. From an entrepreneurial perspective, we can see that entrepreneurs who are trying to be ‘creative destructors’, developing radical innovation that disrupts stable markets and mainly target the ‘innovators’ and ‘early adaptors’ have a sense of entrepreneurial alertness that we call seeking new opportunities, whereas entrepreneurs who are waiting longer to adapt their offering and only jump on board when markets are re-establishing again have an entrepreneurial sense that we call seizing (existing) opportunities. In order to function properly, markets need both types of entrepreneurs.

Crisis-triggered Innovation

However, it’s not only entrepreneurs seeking for creative destruction that will initiate market disruptions, it can also be a range of external factors. In innovation theory we distinguish between two types of innovation:

- Endogenuous innovation: this perspective on innovation economics basically describes that innovation is inevitable. The longer a market is in a stage of an equilibrium, the higher chance will be that an entrepreneur will break that equilibrium. As a result, disruptive innovation is only a matter of time (Antonelli, 2017).

- Exogenous innovation: this perspective on innovation economics describes the fact that disruptions in markets will occur because of specific external events that trigger the disruption. These events can be called crises or discontinuities. These crises can be initiated by for instance natural phenomena, but also by human behaviour (societal changes).

Both endogenuous and exogenous innovation will trigger a change in the difussion of innovation, starting off with the ‘valley of disruption’: the point in time where markets hibernate because of an on-going crisis.

Establishing the new normal

After the initial valley of disruption, markets will follow a typical recovering process that will bring them to a new baseline. When in crisis, academia are usually the initiator of new and innovative technologies needed to tame the crisis. New technologies gain attention (a little too much at first, the hype, followed by the valley of death) before venture capital or crowdfunding comes available and entrepreneurs start to take over and bring new solutions to market. In his work, Bessant et al (2015) describe 5 stages of crisis-driven innovation:

- Crisis

- Observatory

- Laboratory

- Prototyping

- Scaling & Difussion

Organizational Latitude

So, the big question here is: what type of organizations are able to get the most out of a crisis? In the visual you can see the difference between market volatility – the variance in markets and sectors that are in disruptive stage – and organizational latitude – the maximum reach of innovation readiness of your organization. If your organizational latitude exceeds the volatility of your market, your organization will be able to deal with any disruption. Although I’m not saying that the following suggestions are inclusive, they are 2 excellent starting points:

- Innovation Ecosystem: organizations who participate in knowledge ecosystems and business ecosystems, are much better able to pursue the valley of death and jump on board of the ‘upper new equilibrium’. Organizations who don’t, are more likely to be worse off after the crisis.

- Teal Organizations: Laloux (2014) describes that so-called teal organizations and 42 ways in which teal organizations differ from other organizations. The more teal you are, the higher your organizational latitude, the better you’ll able to survive the crisis.

In this visual you’ll find all of the above visualized, including Laloux’s 42 characteristics of Teal Organizations.

Download

This infographic is part of the book Innographics: A Visual Guide to Innovation Management

Download a 32-page preview for free

Including 2 infographics, 2 chapters and an overview of 28 innographics.

☑ I agree with opting in for the newsletter, our terms and privacy policy.

Bibliography

Antonelli, C. (2017). Endogenous innovation: The economics of an emergent system property. Edward Elgar Publishing.

Bessant, J., Rush, H., & Trifilova, A. (2015). Crisis-driven innovation: The case of humanitarian innovation. International Journal of Innovation Management, 19(06), 1540014.

Kirzner, I. M. (1999). Creativity and/or Alertness: A Reconsideration of the Schumpeterian Entrepreneur. Review of Austrian Economics, 11, 5–17.

Laloux, F. (2014). Reinventing organizations: A guide to creating organizations inspired by the next stage in human consciousness. Nelson Parker.

Rogers, E. M. (2010). Diffusion of innovations. Simon and Schuster.

Schumpeter, J. (1942). Creative destruction. Capitalism, socialism and democracy, 825, 82-85.